The average annual income of sugar daddies in the United States has climbed to $250,000, according to new research examining the financial profiles of participants in the sugar dating market. The figure represents a 15% increase from 2020 estimates and reflects broader shifts in both the industry’s composition and the American economy’s wealth distribution patterns.

The Sugar Dating Research Institute (SDRI), a non-profit organization analyzing trends in alternative relationship models, conducted the study by surveying over 5,000 participants across major platforms between January and June 2023. The findings, released in October, have prompted reactions from platform operators, economists, legal experts, and advocacy organizations, each interpreting the data through different lenses.

Income increases track broader wealth concentration trends

The research documents a shift in the demographic composition of sugar dating participants toward higher-earning professionals. According to the SDRI report, 60% of sugar daddies now hold executive or entrepreneurial positions, with technology, finance, and real estate sectors representing the largest professional concentrations.

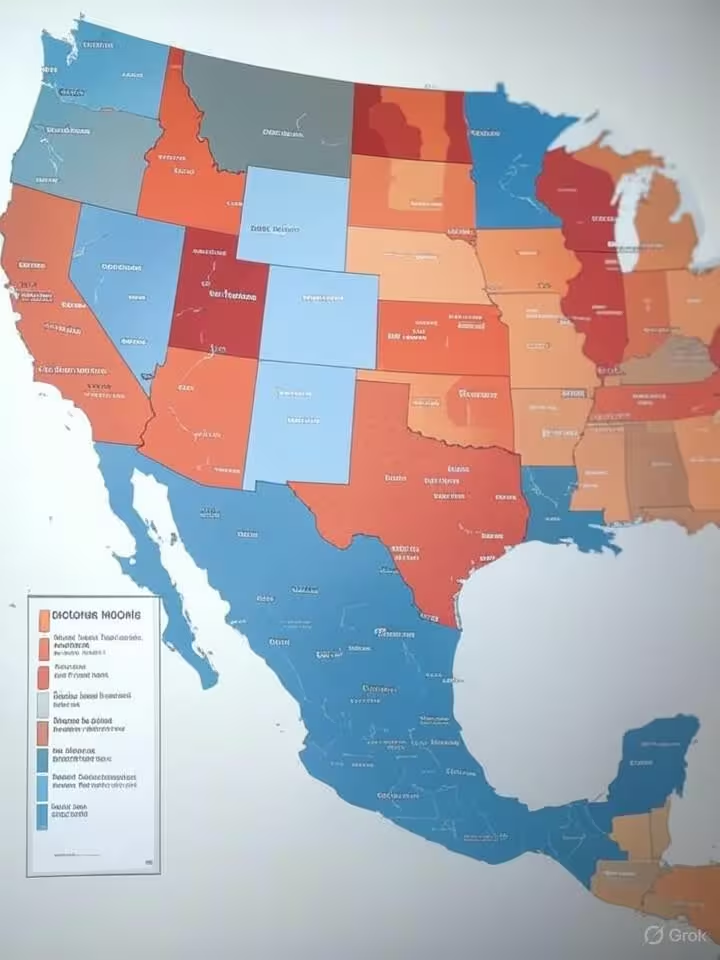

Regional variations in income levels proved significant. Sugar daddies in coastal metropolitan areas including New York and San Francisco reported average incomes exceeding $300,000, while participants in Midwestern states averaged $200,000. The study found that 75% of respondents reported net worth figures above $1 million.

“This data points to a maturing industry where participants are increasingly from established economic backgrounds,” said Dr. Elena Vasquez, lead researcher at SDRI, in a statement accompanying the report’s release.

The methodology relied on anonymous online questionnaires distributed through partnerships with sugar dating platforms. The research team acknowledged limitations inherent in self-reported financial data, which could introduce biases toward higher earners more willing to disclose income information.

Platform operators report corresponding user base changes

Representatives from major sugar dating sites confirmed that the study’s findings align with internal platform data showing shifts in user demographics. Seeking Arrangement, among the largest platforms in the market, reported 20% growth in premium memberships from users verifying incomes above $200,000.

“We’ve seen increased engagement from high-net-worth individuals, which aligns with the SDRI findings,” a Seeking Arrangement spokesperson stated in response to questions about the research. The company noted that premium membership verification features introduced in 2022 have contributed to the demographic shift.

However, operators of smaller platforms expressed concerns about market segmentation. Mark Thompson, CEO of SugarDaddyMeet, addressed accessibility questions during an industry webinar in November.

“While higher incomes might elevate the industry’s profile, it could alienate potential users from diverse economic backgrounds,” Thompson said, emphasizing the need for marketing approaches that maintain broader user base diversity.

Platform revenue data supports the user base evolution documented in the study. According to App Annie, an industry analytics firm, sugar dating platforms experienced 12% year-over-year revenue increases in 2023, driven primarily by premium subscription growth and income verification features.

Verification technology drives demographic shifts

The introduction of income verification systems has played a significant role in attracting higher-earning participants. Major platforms now offer verification services that authenticate financial claims through third-party services or documentation review.

A Deloitte report on alternative economies noted that platforms are “leveraging technology to authenticate user finances, which builds trust and attracts wealthier demographics.” This technological evolution has reshaped platform positioning within the broader online dating market.

Economists link findings to broader wealth inequality patterns

Economic researchers examining the SDRI data have positioned the income increases within larger patterns of wealth concentration in the United States. Dr. Robert Kline, an economist at the University of Chicago, characterized sugar dating as “a microcosm of economic disparities, where affluent individuals seek companionship amid busy lifestyles.”

Kline’s analysis, published in the Journal of Economic Perspectives, connects the phenomenon to rising executive compensations in technology and finance sectors. Bureau of Labor Statistics data shows that management occupation wages increased 4.1% in 2023, paralleling the sugar daddy income growth documented by SDRI.

Federal Reserve data indicating that household net worth reached record levels in 2023, driven by stock market gains and real estate appreciation, provides additional context for understanding the wealth available to sugar dating participants.

“The income figures reflect who has disposable resources in an increasingly stratified economy,” Kline explained in an interview. “These arrangements exist at the intersection of time scarcity among high earners and economic opportunity seeking among younger participants.”

Demographic age patterns reveal work-life balance factors

The SDRI research documented that 85% of sugar daddies are over 40, with many citing work-life balance considerations as participation factors. This finding corresponds with Pew Research Center data on loneliness among high-earning professionals, which found that 40% of executives report feeling socially isolated despite financial success.

“The age concentration suggests that sugar dating serves specific needs for established professionals seeking companionship arrangements that accommodate demanding careers,” Dr. Vasquez noted in the research report.

Critics raise concerns about power imbalances

Advocacy organizations have responded to the income data by highlighting concerns about power dynamics in arrangements characterized by significant financial disparities. The National Center on Sexual Exploitation has emphasized vulnerability questions, particularly regarding younger participants.

“High incomes can exacerbate vulnerabilities, particularly for younger participants,” said Haley McNamara, a policy analyst at the organization, in response to the study’s release.

McNamara pointed to academic research examining how economic disparities may influence relationship dynamics, though she acknowledged that not all arrangements involve exploitation. The organization has called for additional research examining outcomes for participants across different economic backgrounds.

Legal disputes increase alongside income levels

Attorneys specializing in family law and contract disputes report an uptick in cases related to sugar dating arrangements. Sarah Linden, a partner at Linden & Associates, noted that her firm handled over 50 such cases in the past year, often involving non-disclosure agreements and financial arrangement disputes.

“With higher stakes involved, we’re seeing more cases involving financial agreements that blur lines with traditional contracts,” Linden explained. “The income increases documented in this study correspond with more complex legal arrangements.”

Legal experts have observed that participants with higher incomes tend to formalize arrangements through written agreements, creating a growing body of contract disputes that courts must navigate without clear precedent in many jurisdictions.

Gender studies scholars examine evolving relationship norms

Academic researchers studying gender dynamics and modern relationships have offered interpretations of the income data that emphasize changing social norms. Professor Maria Gonzalez from Stanford University, whose research examines contemporary relationship models, argues that sugar dating reflects both challenges to traditional norms and reinforcement of economic dependencies.

“These arrangements exist in tension—they challenge conventional relationship structures while simultaneously creating new forms of economic interdependence,” Gonzalez wrote in a recent paper on modern relationships.

Her research, which surveyed 800 sugar dating participants, found that 70% of sugar babies reported educational or career benefits from arrangements, providing data that complicates narratives focusing exclusively on exploitation. However, Gonzalez emphasized that economic benefits don’t eliminate power imbalance concerns.

“The question isn’t whether participants derive value, but rather how significant income disparities shape the terms and dynamics of these relationships,” she explained.

Regulatory scrutiny may intensify as industry visibility grows

Legal experts anticipate that rising income levels and increased platform revenues may attract regulatory attention from lawmakers examining online platforms’ roles in facilitating various types of arrangements. Recent congressional proposals have explored regulatory frameworks addressing platforms that enable gig economy work, which some lawmakers view as comparable to sugar dating platforms.

Dr. Jonathan Hale, a legal scholar who authored a briefing paper for the American Bar Association on platform regulation, warned that “as incomes rise, so does visibility, which could lead to more oversight.”

Several state legislatures have considered bills that would impose disclosure requirements or age verification mandates on sugar dating platforms, though none have advanced to passage as of late 2023. Platform operators have generally opposed such measures, arguing that existing age verification systems and terms of service adequately address regulatory concerns.

International regulatory models offer potential precedents

Some legal analysts point to regulatory approaches in other countries as potential models for U.S. policy development. Australia and several European nations have implemented platform transparency requirements that mandate disclosure of business practices and user protections.

Whether similar frameworks might apply to sugar dating platforms remains an open question that could become more pressing if the industry continues growing and attracting higher-income participants who bring greater financial resources to arrangements.

Industry observers forecast continued income growth

Economic forecasts suggest that average sugar daddy incomes may continue rising in coming years. Industry analysts project potential growth to $275,000 by 2025, based on Goldman Sachs economic forecasts for executive compensation in technology and finance sectors.

Remote work trends enabling geographic flexibility for high-earning professionals may contribute to income growth, as professionals in expensive coastal markets can participate in arrangements while residing in lower-cost regions, effectively increasing disposable income.

The SDRI announced plans for follow-up research examining how income levels correlate with arrangement characteristics including duration and satisfaction measures. Preliminary data from the current study suggests that higher-income sugar daddies report longer-term engagements, averaging 18 months compared to 12 months for those with below-average incomes.

“Understanding how financial resources shape arrangement dynamics will be crucial for platforms, participants, and policymakers,” Dr. Vasquez stated in discussing future research directions.

Study methodology raises questions about representativeness

While the SDRI research provides the most comprehensive recent data on sugar daddy incomes, methodology limitations warrant consideration when interpreting findings. Self-reported financial data can introduce biases, with participants potentially inflating income claims or those with lower incomes declining to participate.

The study’s reliance on participants recruited through platform partnerships may also skew results toward active users of major platforms, potentially missing participants who use smaller sites or informal arrangement networks.

“Any survey of this population faces inherent challenges,” acknowledged Dr. Vasquez. “We’ve attempted to account for biases through sample weighting and validation checks, but readers should understand these limitations when considering our findings.”

Despite methodological constraints, the research represents the most extensive effort to document sugar daddy income levels since 2020, providing data that platforms, researchers, and other stakeholders can reference when examining industry trends.

Economic context shapes industry evolution

The $250,000 average income figure emerges from a specific economic moment characterized by wealth concentration, stock market gains benefiting asset holders, and compensation growth in specific professional sectors. How sustainable these conditions prove, and whether they represent lasting shifts or temporary phenomena, remains to be seen.

For an industry that has grown from niche origins to include millions of participants across multiple platforms, the income data provides one metric for understanding who participates and how the market may evolve. Whether rising incomes lead to greater mainstream acceptance, increased regulatory scrutiny, or market segmentation will likely depend on broader social and economic trends beyond the industry itself.

As the sugar dating market continues maturing, the interplay between participant demographics, platform business models, regulatory frameworks, and social attitudes will shape an industry that increasingly attracts attention from researchers, policymakers, and media observers seeking to understand contemporary relationship patterns and economic behaviors.